Enter GSTIN

What is GST Number (GSTIN)?

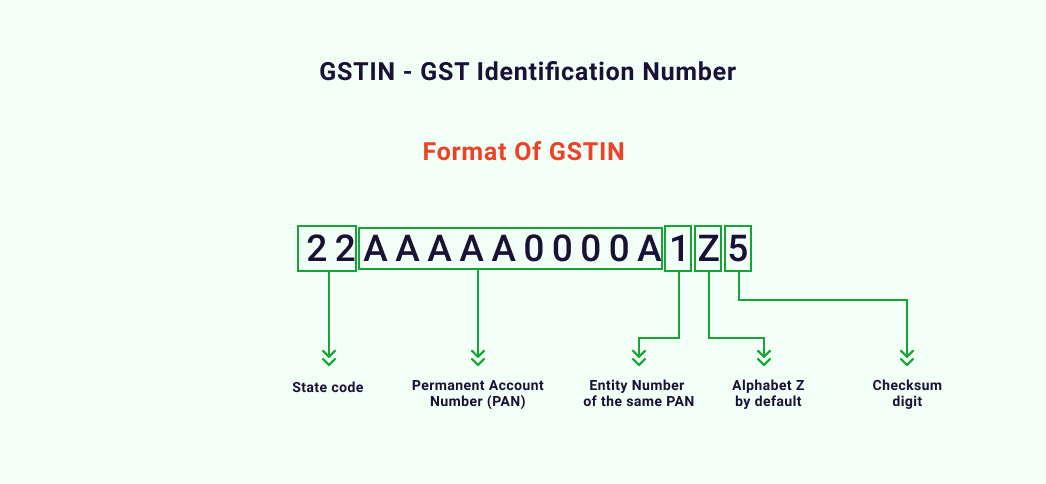

GSTIN or Goods and Services Tax Identification Number is your unique business identity with the GoI (Government of India) that contains 15 digits alpha-numeric PAN-based code.

Why is it important to verify GSTIN or GST Numbers?

Verifying GST Number or GSTIN is very important as there are many cases where individuals manipulate GST Number (GSTIN). In addition to this, the GST Number search will help you to maintain transparency in all the business transactions and will ensure that you are filing correct GST Returns for the particular tax period. Further, GSTIN verification will also help you to claim Input Tax Credit that you might lose because of the fake GSTIN.

Verifying GSTIN or GST Number is the need of the hour to ensure that your paid GST taxes land up in the right pockets. It is also your opportunity to contribute towards nation-building.

GST Number Search Tool

It is high and a good time to increase your awareness about GST Number, its quick authentication, and related facts:

- GSTIN Misuse

- Verify GSTIN online instantly

- GSTIN or GST Number structure

- Where and how to complain about fake GST No.?

GSTIN Misuse:

There can be instances where the supplier could manipulate customers by GSTIN Misuse. Here are some basic misuses of GSTIN:

- Fake GSTIN

- Bogus inward invoices

Verify GST Number Online Instantly:

The GST Search, a 100% online module has the remedy and GST number verification is just a few taps on your smartphone and you’re fed with the details within few seconds. There are two ways to verify GSTIN online instantly:

- Masters India – GST Number Search Tool: As shown above, just enter the GSTIN or GST Number to be looked for in the search tab, in the correct format, and click on ‘Search and Verify GST Number’ to find GSTIN information. The GSTIN Verification tool fetches the data directly from the GSTN portal and displays the GSTIN search results. It’s that simple.

- Logging at the GST portal: Go to https://www.gst.gov.in/ – click on the dropdown of the Search Taxpayers – click on Search by GSTIN/UIN – enter the GST Number mentioned on the invoice in the search column – enter the captcha shown and click on Search.

GSTIN Structure:

It has also come to notice that the guys have devised innovative ways to fool people and ultimately the government. They just put an alpha-numeric code, against the GSTIN heading to dupe the consumers, which unarguably resembles a GSTIN. It is also critical to know, how a GSTIN is structured to spot any malpractices. Let us see, what constitutes a 15 character GSTIN or GST Number:

- The first 2 digits denote the unique state code in accordance with the Indian Census 2011. For instance, the state code of New Delhi is 07 and that of Karnataka is 29.

- The next 10 characters denote the PAN number of the taxpayer.

- The 13th digit denotes the registration number of the taxpayer with the same PAN number.

- The 14th digit is ‘Z” by default for all – not intending anything currently

- The 15th digit is the check digit – can be a number or an alphabet.

Knowing the above bifurcation can also come to help, when you’re in a dilemma about the authenticity of the GSTIN while paying at the cash counter of your local merchant.

Where and how to complain about fake GSTIN?

Should you ever come across and spot any deviation about the GSTIN, you must know that you can also be a whistleblower. You can search GST Numbers on the website and let the authorities [Noida / Gurgaon] know of any illegality by e-mailing them and also call them at helpdesk@gst.gov.in | +91 124 4688999 / +91 120 4888999.

Consumers must make efforts while paying any invoice to ensure that the GST number mentioned on the invoice exists at https://www.gst.gov.in/ to ensure that their hard-earned money goes to the right pockets when paying for a GST invoice.